While subscription video services accumulate and the portfolio of Internet users is not infinitely expandable, the video platforms funded, 100% or in part, by advertising have a playing card.Even in France.

A few months after Disney, it was the turn of another Hollywood mastodon to embark on the battle of video streaming, on April 15.Access to the new nbcuniversal platform, Peacock, has been offered since that date to Cablo-Optor Comcast customers, before an opening to all, scheduled for July 15.It will then cost Americans $ 9.99 a month to take advantage of a platform that hosts the contents of the Universal and DreamWorks studios, as well as those of the NBC and Telemundo channels.However, this will not be their only option.Because Peacock has decided to mix its economic model by including advertising.Customers will be able to lower the price of their subscription from 9.99 to 4.99 dollars per month, if they agree to be exposed to advertising.They can even access a completely free and financed offer, but much more chick in quality content.

Peacock did not invent anything.The video platform was inspired by a market history, Hulu.The service held by The Walt Disney Company, 21st Century Fox, Comcast and Warnermedia has offered its users since 2015 to reduce the price of their subscription (from 11.99 to 5.99 dollars per month) in exchange for a littleCAUTION Advertising."Not far from 70% of its 30 million subscribers allowed themselves to be tempted by the offer," observes Ariane Bucaille, Partner specializing in telecommunications and the media at Deloitte.This ratio increased again in the last quarter of 2019, the number of subscribers at the strong price without advertising having dropped.And it is not surprising to believe Francois-Xavier Le Ray, Country Manager France of the advertising platform The Trade Desk."More and more Internet users are ready to watch advertising before their favorite episodes if it allows them to lower the price of their subscription."They are 53% in this case according to a study carried out by The Trade Desk and Yougov in early 2020.

The study is interested in what the Americans baptized the "fatigue subcription".Understand that the outbidding of paid subscriptions has led to weariness in consumers whose attention time and the portfolio are not infinitely stretch.Also according to The Trade Desk and Yougov, 60% of Americans do not want to spend more than $ 20 per month in paid video services (SVOD).While the undisputed leader, Netflix, costs an average of $ 10, that the star of the moment, Disney+, costs 7, that leaves little room for others.This leaves, however, much more to all free services, funded by advertising.We are talking about Avod platforms here, for advertising video on asking.This market will represent nearly $ 32 billion in the world in 2020 according to Deloitte, which estimates market growth at more than 50% over two years.

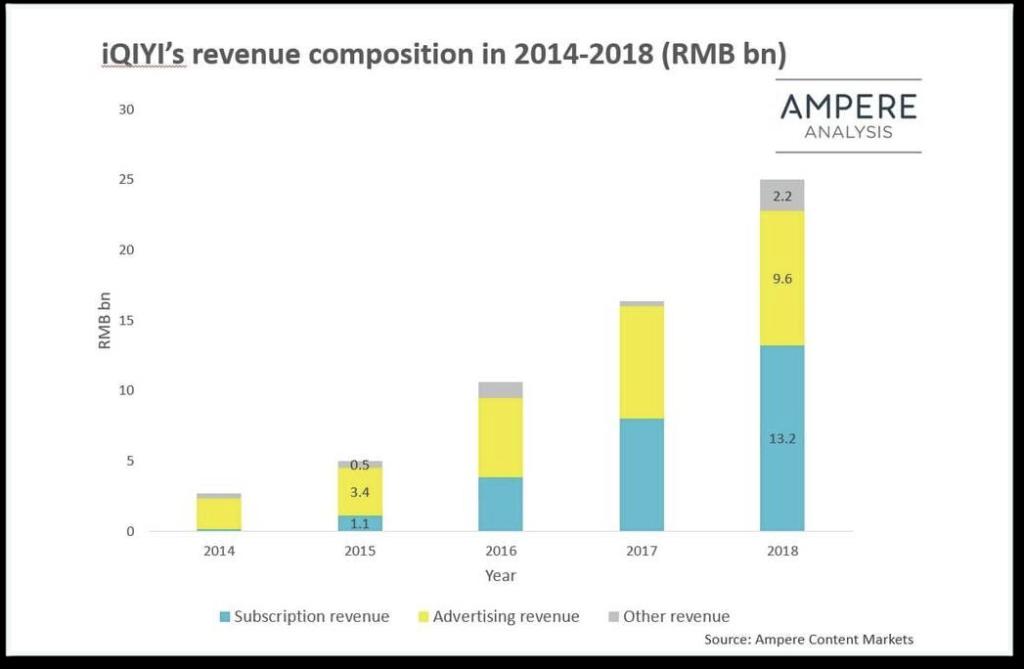

"The AVOD sector is mainly worn by two markets: Asia and the United States," observes Ariane Bucaille.In the United States, the sector is in full boom, worn by actors specializing in the aggregation of content acquired from having-law.Two of them recently drawn the attention of networks.Pluto TV was bought 340 million dollars in mid-2019 by Viacomcbs while Tubi and its 25 million active users were acquired in March 2020 by Fox Corp, Rupert Murdoch, for $ 440 million.With an income per user (ARPU) which is around 60 dollars per year in the United States according to Deloitte, against 98 dollars on average for the services of SVOD, the model also proves that it is competitive.

And it is essential in a market where leaders spend ten billions of dollars per year in content."Actors like Peacock or Quibi have a rather premium positioning, which involves obtaining massive audiences to make their investments profitable", decrypts Gilles Pezet, media expert at NPA Conseil.In terms of premium content, IMDB.TV, the AVOD service launched less than a year ago by Amazon, is not to be outdone.The platform has just added series like Lost and Desperate Housewives in its catalog and plans to invest in original content.We can also cite Quibi, co-founded by the old HP boss, Meg Whitman, around a mobile-first offer and short content.The positioning of this actor launched in early April is reminiscent of that of the pioneers of the Asian market, the other strong AVOD market."In Asia, leaders are free mobile video platforms which, once they can rely on an installed base, invest in exclusive content, especially sport, to complete their offer with a premium and paid service",observe Ariane Bucaille.This freemium model is made possible by the size of the Asian market.An actor like Hotstar managed to reach 200 million subscribers there.

Difficult for European players to hope to reach such figures, the market being much smaller and fragmented.Rakuten TV, who launched his AVOD offer in October 2019 following the acquisition of the Spaniard Wuki.TV, claims to be the number one in its sectors of the top of its ... 8 million users.It is however present in around forty countries and in the four main connected TV manufacturers who even joined aRakuten TV button on their remote controls (nearly 90 million households)."We are still only in the beginning in Europe, the use is less installed," reassures the vice-president of Europe in the south of the group's advertising division, Edouard Lauwick.It must also be said that the catalog ofRakuten TV suffers from the comparison with that of Netflix.The platform recycles a good part of the old film catalogs whose rights are more affordable."But Netflix has also been there.More than 50% of the content offered at its launch was over 5 years old according to a study by Ampere Analysis ", notes Sébastien Robin, consultant specializing in OTT video.Rakuten.TV also begins to invest in exclusive and fresh content, like the series in eight episodes shot with FC Barcelona (of which its e-commerce branch is sponsor) or the documentary turned on another football star,Senegalese Sadio Mané.

In Europe, the United Kingdom and Germany are, without surprise, the heads of bridges of the AVOD.It is no coincidence that these are the only two European countries where the American Pluto.TV has already launched."France is two or three years behind these two markets," said Sébastien Robin.It must be said that we are far from having reached the fatigue subcription of our American friends."Behind Netflix, there was, until the arrival of Disney+, not many people, recalls Gilles Pezet.We are also an average of 1.5 home subscription against 4 in the United States."The fact remains that the French will also have to make choices one day."Which will allow an advertising offer to exist," says Sébastien Robin.Market leaders are currently two platforms well known to the French: MyTF1 and 6Play.

"The French AVOD market is driven by the offer of TV channels which sees it above all a good supplement to their linear offer," notes Ariane Bucaille.TF1, however, showed the muscles by proceeding last summer to a redesign of its platform."We are the first actor in France to set up a permanent AVOD strategy, with more than 4,000 hours of exclusive MyTF1 content, in addition to the 3,000 hours of replay," said the group's antennas director, Xavier Gandon.The platform has acquired foreign series rights such as Clique or Anzak Girls and even launched in the production of Digital Reality TV like "Jazz and Laurent, the family is growing" of which certain episodes combine several million views."These investments are directly integrated into the overall budget for chain programs," says Xavier Gandon.This was 985 million euros in 2019.On the audience side, it remains stammering.This excluded content contributes 15 to 20% of the platform audience.The replay therefore remains the pillar of the offer of MyTF1.Which makes Ariane Bucaille say that we should not expect "a revolution in the global economy of hexagonal TV".

Especially since French actors do not have the means of a Netflix which loses a lot of money and "will only be profitable once reached the threshold of 400 million users", as Sébastien Robin recalls. Les TF1,Rakuten.TV and others will also have to sell a lot of advertisements to hope to line up with the income of SVOD platforms."The CPMs of the French market are, for a reason that I do not explain myself, twice lower than those of the English and German markets," recalls Sébastien Robin.At 15 euros from the CPM, or 15 euros every 1,000 advertisements, it is necessary to broadcast 10 advertisements per day and per user to reach an arpu of $ 5 per month, according to the calculations of our expert.It is for an actor like TF1, who adapts two to three pre-rolls per program, more than playable."The larger the groups and have well -equipped digital agencies, the easier it is to hope for this type of service," notes Gilles Pezet.An obvious solution would be to opt for an alliance, like the one launched by Prosiebensat.1, Discovery, Ard and ZDF in Germany with Joyn.This will not be the case in France.Salto, the platform that brings together TF1, France Télévisions and M6, will be exclusively paid."In France, it is each for their part for the Avod and Salto for the charge," sums up a channel leader.

On the advertiser's side, the demand is real. Avant même son lancement, Quibi, qui est également disponible en France, annonçait avoir vendu l'intégralité de son inventaire pub pour sa première année d'exercice (soit 150 millions de dollars) à 10 annonceurs dont Procter & Gamble, Taco Bell, Pepsi, T-Mobile, Google et Walmart.The platform offers a "responsive" revolutionary format which allows video advertising to appear differently depending on whether the user consults it vertically or horizontally.In the United States, Hulu has accumulated nearly $ 670 million in advertising turnover in 2019, half of which are only last quarter.If advertising remains a periodic business, and the end of the year is always a highlight, this reflects a strong acceleration of business.The platform allows you to target the binge watchers.The opportunity for a brand to sponsor an episode that a user is about to see during his viewing marathon.Hulu, which rejects all of its advertising offer in 2020, also wants to allow users to choose the types of advertisements they agree to receive.Another format tested, ads pause: when the user takes a break in his episode, a translucent banner enjoins him to take advantage of this parenthesis to buy a product that he has already consulted on an e-commerce site via retargeting.The platform, which launches its vertical Hulu Kitchen, plans to integrate utensils of partner brand kitchens, which subscribers could buy in a single click.

All these actors also offer advertisers to target ads with socio-demo and behavioral data."The television addressed makes it possible to offer differentiated spots according to the viewer, depending on different criteria such as age, social category or geographic location", recalls François-Xavier Le Ray.Clearly, to do as on the web but in a more premium context, worthy of TV."90% of our inventory comes from connected TVs in France", figure Edouard Lauwick.The platform plans to allow brands to associate with specific content which they feel close.

LesRakuten.TV and others are all the more optimistic as they see in their AVOD model an alternative to the offer of Google and Facebook.While the latter capture almost 70% of the digital advertising market, French advertisers want to have other options."AVOD platforms will allow advertisers to extend their reach while retaining the serious advantage of offering secure contextual environments, suitable for all audiences," adds François-Xavier Le Ray.In the United States, it is already a well-established reality.In France, evangelization is less pronounced."I think it will flow at least two years before the market really takes off in France," said Sébastien Robin.A prognosis all the more likely since the coronavirus has since passed through there.Because it is more difficult to innovate and take risks in a sluggish market ...

This article was also published in Adtech News, paper supplement from CB News magazine, dedicated to Adtech and Martech.In the May edition, a file on the Advertising Video On Demand market, an interview with the SEB group, the programmatic barometer, a focus on pub in the push notives Etun subject on Kawarizmi.

Samsung Galaxy S22, Uncharted et pl...

Tesla: you can now enjoy YouTube in...

EM – Butler vs Purdue Basketball Li...

Nantes. A child victim of an acci...