LA TRIBUNE- What lessons can we learn from past pandemics in economic and health terms?

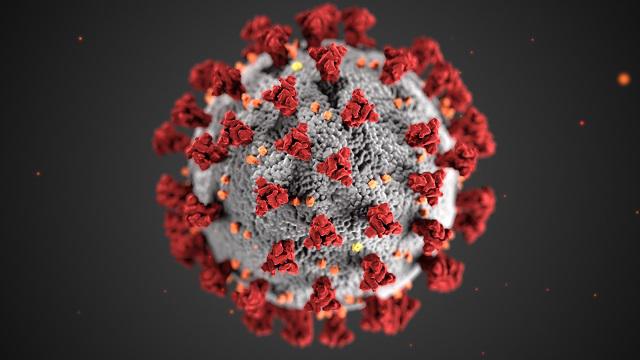

ROBERT BOYER- The first lesson is that people have had the illusion since the postwar boom that pandemics were a thing of the past. However, long history shows the succession of pandemics. Several valuable lessons can be learned. Recurrently, epidemics surprise doctors because it is a new virus or a new bacterium: how are they transmitted and how to fight them? The second lesson is that these pandemics can last from two to twenty years, so they are not one-time shocks, if only because of the uncertainty of virus mutations. Governments are implementing quarantines and the equivalent of contemporary science advice. Many of the public devices are often invented during these periods.

Pandemics also have a religious dimension. Believers explain that it is the return of God and others invoke the vengeance of the Earth, the goddess Gaia. Finally, they are also an opportunity for significant progress in public health. In fact, what seems new to contemporaries often comes from ignorance of history, because pandemics have constantly marked the evolution of humanity. The amazement caused by the probable return of pandemics shows how much we have overestimated the power of medicine and neglected prevention.

> Read also: The Spanish flu, the terrible precedent

Is the pandemic reshuffling the cards of globalization and international relations?

Yes, absolutely. Even before Covid-19, Europe was already suffering from major imbalances. On the one hand, the countries of the North posted trade surpluses and continued improvement in the standard of living, as observed in Germany, the Netherlands and Denmark. On the other side, in the South, in Spain, Italy or France, either living standards are stagnating or the trade deficit is widening.

In the first phase of the health crisis, the North fared better than the South. Germany was first seen as a model, although this perception changed with the explosion of variants in the spring of 2021. Subsequently, the health crisis was extremely severe in Italy, Spain and France, as much of countries whose tourist activity has collapsed. As a result, the pandemic has aggravated the structural imbalances in the Euro zone. The manufacturing industry resumed its long-term trend while tourism is still suspended. At the June 2020 summit, the European Council decided to spend 850 billion euros to compensate for these imbalances because they jeopardize the euro, but it is slow to be implemented as a third wave of the pandemic.

On a global scale, all eyes have turned to Asia. Are Asian countries going to be the big winners?

On a global scale, the catastrophic management of the pandemic in the United States has given primacy to Asia. Many East Asian countries have dealt with the pandemic better than European countries or those in America. As a result, they benefit from a more problematic return to growth. In Europe, the health crisis has accelerated the world's shift towards Asian capitalisms.

The economies that emerge stronger from the crisis are those that are already well advanced in the digitization of platform services and/or in the biotechnology industries applied to medicine. On these two criteria, the Old Continent comes out relatively weak. The European Union has not been able to produce vaccines in time and it has no champion among GAFAM. Europe is marginalized, despite President Biden's desire to ally with democratic countries, and it no longer has the privileged place it had in American relations since the end of the Second World War.

Health diplomacy confirms this geopolitical shift, when, for example in 2020, China sent masks to Europe. In 2021, China and Russia are deploying vigorous vaccine diplomacy to increase their influence over African and Latin American countries. Thus the pandemic marks an acceleration of geopolitical polarization even though it was a common challenge.

Health nationalism is recurrent and adds additional tension to the stability of international relations. The year 2020 has a chance to be a milestone in the history of societies and the world economy.

> Read also: "The dangers of globalization have been underestimated, despite the advice of specialists"

In your latest book, you work on several hypotheses. What types of capitalism could this crisis lead to?

Since the early 2000s, digital platform capitalism has continued to gain momentum and Covid-19 is further accelerating this movement. The rise of telemedicine, distance commerce and continuous information have enabled increasing returns to be expressed on a global scale. The GAFAM are the platforms accessible to the whole world with the exception of China which has its own champions of the digital economy. These increasing returns on a planetary scale have created an unprecedented interdependence. Previously, markets were often local, national or regional across a continent. The GAFAMs have created the infrastructures of a global market.

These global platforms have taken advantage of "the contactless society"...

This is a major change. In the context of the pandemic, these platforms are thriving, for example by taking advantage of the need for physical distancing and the reduction of face-to-face relationships. In a sense, they canceled distance and time. Transactions, medical consultations, courses, professional meetings were always possible and teleworking is exploding. If the financial markets have held up, it is because they believe in the future of digital technology and biopharmaceuticals. Given the uncertainty, markets have found their compass and lifeline. This crisis should have destabilized the stock markets. However, even if they shattered at the start of the pandemic, the success of GAFAM and the announcement of vaccines boosted the optimism of financiers and therefore stock prices. It is only a terrible crisis for traditional capitalism, especially in the area of services. This crisis is a remarkable accelerator of the globalization and digitization of companies. This crisis is in no way a reissue of that of the 1930s.

You worked on the period between the wars. Many observers hope for a return to the "Roaring Twenties", the famous "roaring twenties". Does this comparison seem relevant to you?

When a war ends, it has caused so much suffering and death that societies aspire to return to an economy of peace, because the horizon is clear. When in France war is declared with the virus, the situation is very different. The virus is in everyone, and it circulates within society and not outside. Declaring war on the virus means entering into conflict with oneself, reducing social interactions and arousing local suspicion to better guarantee health security. Moreover, the end of the pandemic is uncertain because the virus does not sign an armistice or capitulation. Without a lasting return to confidence, there is no possibility of a Roaring Twenties. It is possible that consumption will explode if health security is restored on a planetary scale. The instantaneous exit from the war made the Roaring Twenties possible. It must be remembered that this decade led to the crisis of 1929. Countries will no doubt travel for a long time from one health uncertainty to another. This decade could look more like pitiful years. The error of governments is to consider that public expenditure is a substitute for public health. If the States do not restore it, public aid will continue to feed the savings of the richest and the crisis will continue to aggravate the impoverishment of the most vulnerable. The proposal that “the screws should be tightened ahead of a return of the Roaring Twenties” is therefore premature.

The economist Robert Boyer, polytechnician and former director of research at the CNRS, leads the Research and Regulation association and collaborates with the Institute of the Americas.

Can this crisis lead to a more environmentally friendly economy?

The pandemic is due to the meeting of urbanization in China, linked to its economic dynamism, and the eating habits of the population. The transmission of the virus from animals to humans passes through the encounter between economic and social life and animal life. At the time of confinement, urban pollution was greatly reduced and CO2 emissions dropped drastically. A frugal lifestyle would therefore help to curb global warming. It should nevertheless be remembered that this way of life was constrained and not chosen. Is public opinion ready to accept a Spartan way of life? Certainly not, because we live in a consumer society and companies are pushed to sell ever more goods marked by planned obsolescence. This tension is obvious. It is possible to fight against global warming but it is necessary to change the accumulation regime of most economies. Consumers are not necessarily ready. Ideally, a majority of opinion can agree to save the Paris agreement, but it is difficult to find the corresponding political compromise. Above all, inequalities have been aggravated by the pandemic. If very strong compensation measures are not planned, the most vulnerable suffer the costs of climate adjustment. The great danger is favoring populist regimes that have flourished for a decade. Never has the political task been so difficult: how to govern fragmented societies plagued by inequalities?

You quote John Maynard Keynes: "Economists are at the wheel of our society right now, when they should be in the back seat." What place should economists have in our society?

In 2020, epidemiologists and their models replaced economists and their formalizations. Admittedly, renowned economists have come back to the fore to establish scenarios for reducing public deficits. Health security is the key to economic prosperity. To do this, the various medical specialties must agree on a diagnosis and means of control. On this basis, economists will be able to work on a way out of the economic slump. We are now struck by the relative consensus of economists of all persuasions who affirm that above all there is no need for premature budgetary austerity. The economist is currently in the back seat. This modesty is welcome because many concepts of standard economics have been invalidated and need to be replaced.

> Read also: Economic recovery: have we (really) all become Keynesians?

Covid debt ignites debate among economists. How do you view these discussions?

The slump comes essentially from a freezing of the economy and then from the difficulty of getting out of it. We must first overcome the causes of the health crisis and restore a viable world because most economies are dysfunctional. It is only later that the economists will be able to resume their role of privileged adviser to the prince. This awareness is ongoing. US Federal Reserve (FED) Governor Jérôme Powel recalled that he was adjusting his monetary policy to the evolution of the epidemic. Chancellor Angela Merkel has long pointed out that her agenda is to respond to the uncertainty linked to the virus. The President of the Republic has just adopted the same modesty.

> Read also: Covid debt: the Arthuis commission advocates a golden rule on spending

You call for re-embedding the economy in societies like the Austrian economist Karl Polanyi, author of The Great Transformation.

When he wrote this work in the 1940s, he started from the observation of the disasters caused by all-out liberalization and the aggravation of inequalities. The system created was so unstable that it collapsed and led to the crisis of 1929 and the rise of totalitarianism. The question posed by Karl Polanyi is that of the social relations that are the foundation of an economy governed by the market. First, work is the support of dignity and life. It is unimaginable that an unemployed person should perish from starvation. Then, the currency must be thought of as the basic institution of a market economy, it is a stabilizing element of the economy under the control of politics, an important principle as to the hopes raised by bitcoin, a source of speculation and volatility. extreme. The preservation of nature is the third pillar of any economy because it should not be seen through the prism of the commodification of ecological services. Labor, money and nature are fictitious commodities that cannot be regulated by pure market logic.

With the pandemic, we have rediscovered the limit of market mechanisms which are proving incapable of ensuring coordination of exit strategies from the health crisis. It appears that the State is the only actor able to insure a systemic risk. It had to intervene as an insurer of last resort against insurance companies that refused to compensate companies prevented from producing. But, above all, it must organize the fight against the pandemic and display objectives against which the actors can form their anticipations and decisions. The pandemic has reminded us that economies need a state, precisely to manage the three fictitious commodities of work (part-time subsidy), currency (change in central bank policy) and nature (plans for “green” investment).

Economics as a discipline is above all a social science. She is completely immersed in history, sociology and politics. This crisis of 2020 will go down in history for two reasons. In the history of capitalisms because, for the first time, almost all countries share the same experience at the same time. In the history of the discipline of economics because the time has come for an updating of theories so that they can shed light on the issues of the time.

> Read also: Karl Polanyi, a current author

What is your view of modern monetary theory (MMT) in vogue in the United States?

It's a good idea to start with. It is healthy to demystify the supposedly natural character of money. It is above all a social construction. Politics has the right to intervene. In Great Britain, the Treasury and the Central Bank have merged, a return to the dogma of the necessary independence of central banks. The public treasury monetizes the British public deficit and, however, the British economy has not collapsed despite the mistakes in the management of the health crisis. During major crises, all the tools must be mobilized. The ECB, by massively buying back national public debt securities, was cunning with its statutes, but it helped to avoid a collapse of the economies. We are poles apart from the conceptions that inspired the foundation of the euro.

On the other hand, it is dangerous to adopt the ultimate consequences of the MMT according to which the budgetary policy makes it possible always and everywhere to reach the full employment and to remain there. Indeed, the United States is fortunate to have the dollar as the world's reserve currency. This modern monetary theory is, perhaps, founded for a country whose dollar is the world reserve currency. In Europe, the euro does not have this status and does not benefit from the extraterritoriality laws enjoyed by the dollar. Moreover, in an open economy, this theory must take into account the fact that the widening of the external deficit strongly limits the possibility of full employment for countries whose productive system is not very competitive. Who would think of applying MMT to America's economies?

> Read also: In Modern Monetary Theory, there is “theory

Norman Gregory15 mins

Share :

Samsung Galaxy S22, Uncharted et pl...

Tesla: you can now enjoy YouTube in...

EM – Butler vs Purdue Basketball Li...

Nantes. A child victim of an acci...