Curious expression that refers to a completely different field: that of art. "Art in the gaseous state" is a book of chronicles and artistic criticism written by Yves Michaux, famous essayist. His book is built around a paradox. We live in the world of the triumph of aesthetics. Everything is supposed to be beautiful: the packaged products, the body-building bodies, the protected and preserved environment, the food on the plates...

It's not the end of the art and there's no need to cry foul. But it's the end of the traditional regime of art, the one where it produced objects.

Which banks for which customers?

The new ways of borrowing and lending would have changed radically. As with art, finance would now be almost everywhere managed, animated and distributed by new actors following a position of principle: trusted third parties (banks) have disappeared from the financial landscape. Credit solicitations are no longer directed to banks or financial institutions. There are no longer middle-men to receive these requests and go through the contents of the credit application file. So, at last, credit seekers no longer have to bother with notes, explanations, drawings and onslaughts of kindness towards bank staff trained to have no imagination and convinced that he cannot be held responsible for anything since the documents he handled had to land in the stomachs of home computers, transformed into data and milled in the mind of such a credit organization, according to its criteria and according to the ratings it would assign.

The question “who?” takes an increasingly disruptive turn. The world of finance and banking is changing faster than we thought and its foundations are cracking under the pressure of increasingly violent forces. Under the effect of a dislocation of the banking and financial plates, we observe the transition from a massive "Rockefellerian" world to a gaseous world, a world where finance and banking are exercised by organizations which have the consistency from megaliths to a world where the functions of the company, including those of the financing company, are split between apps, software, protocols without it being possible to answer the "who?" and consequently, without being sure of “where?” banking and financial services.

Fizzy, because it is no longer possible to locate services

They are delivered from a delocalized combination of skills unlike the old model of banking and financial institutions, necessarily localizable, solid thanks to hierarchies similar to the lines of force which ensure the perfect stability of a building, places where we know how to go and which, to get closer, multiply into secondary places, in the form of counters of agencies, branches, subsidiaries; Contrary, therefore, to this old model which mobilizes human skills installed in premises adapted to the reception of customers, a new model would be set in motion.

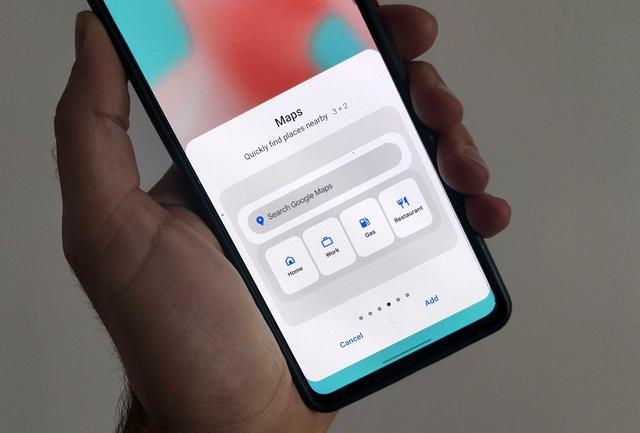

If we kept the expression "my bank", we would really have to take it in the absolute truth of the term and break down its components: I mobilize my bank from my computer, my "wallet", my network, of my key and I activate the "smart contract" guarantee, the "smart contract" interest, etc.

However, I activate the “smart contract”… is not even coherent: in truth, I chose among the different solutions available on the app market and I selected one, which I will forget maybe a little later for another cheaper, more efficient one.

So the ultimate neo-bank will be an unstable conglomeration of bits of banking functions operating under the safe custody and protection of a blockchain, the best of course, or more accurately, the best yet.

But let's recognize that consumers will finally be freed from trusted third parties, all those who used to hoard themselves on their backs as underinformed consumers. But we also recognize that putting in place solid rules of supervision and regulation will not be easy. As difficult as confining a gas and checking the compliance of its particles.

Pascal Ordonneau, former CEO of HSBC invoice finance, is secretary general of the Institut de l'Iconomie.

Farewell Touch Bar, I won't regret...

Caddy, the only web server to use H...

Burkina Faso / Gabon (TV / Streamin...

What the future of work will not b...