The pandemic continues to disrupt global trade circuits. According to a recent study by credit insurance specialist Euler Hermes, the price of maritime freight from China for European firms could soar by 6% by the end of April in Europe. In the United States, this increase would be more contained (+2%). For several months now, many industrialists and economists have been sounding the alarm about these risks. Some sites are curtailing their production due to container shortages.

Shortage of containers drives up prices

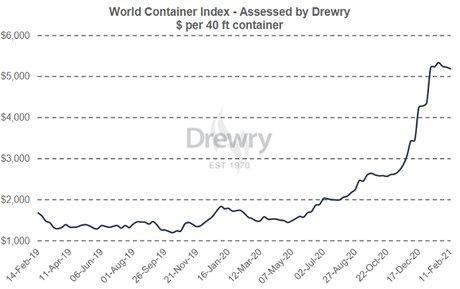

The sea freight market is currently under high pressure. Indeed, many container ships and containers are currently blocked in ports due in particular to the implementation of health restrictions. As a result, there are currently not enough boxes in China to ensure deliveries to the rest of the world. This is causing freight prices to skyrocket across the globe. The Freightos Baltic Index, an index that measures the price of container shipping, nearly quadrupled in three months for the route from China to Europe, rising from $2,119 on Nov. 1 to $7,827 last week. As for the consulting firm Drewry, the world container index has soared in recent months. “The price of maritime freight between Europe and Asia has practically quadrupled and that between the United States and Asia has doubled in recent months,” explains Françoise Huang, Asia economist at Euler Hermes interviewed by La Tribune.

-

-

Stricter sanitary measures inside ports, logistics centers or empty container storage depots, implemented from the start of the Covid-19 pandemic, continue to add their grains of sand to each stage of the supply chain to ultimately create real bottlenecks.

A risk on inflation?

The increase in the cost of transport first has an impact on company margins. If the transport firms do well, the others could cut back on their margins. "Activity has picked up in China faster, which has caused imbalances. The appreciation of the Yuan has had an impact on the price of imports from trading partners. We expect a rise of 6% year-on-year by for European companies and by 2% by July in the United States. This increase in the cost of transport should first have an impact on the margins of companies. Freight companies have seen their margins increase. On the other hand, the Importing companies in the euro zone could see their margins fall between -4.5 and -7 percentage points and in the United States between -2 and -4 percentage points depending on the consumer price transmission scenarios. by households during the crisis," she said. It is still difficult at this stage to make bets on the evolution of consumer prices. "In the short term, it is first of all a shock to corporate margins. In the medium term, the pandemic has accelerated China's place in the global economy. Its center of gravity has quickly shifted towards the Asia. Given the growing economic weight of China, this could have an impact on inflation, but it is still difficult at this stage to draw up scenarios. There could be more volatility on certain products such as semiconductors. " Several automotive manufacturers are currently suffering from serious shortages of components and electronic chips.

> Read also: Automotive: five questions to understand the semiconductor crisis

Germany and France exposed

In Europe, German companies dependent on China could suffer heavy losses of around 36 billion euros in the first half of 2021. On the side of France, importing companies should also see their margins melt with a loss of earnings estimated at 23 billion euros during the first six months of the year. "This shortage, coupled with other factors (reorganization of value chains, production interruptions, strengthening of sanitary restrictions), has the consequence of extending delivery times. We estimate that this extension of delivery times could cost - 1.2 point of growth in the GDP of the euro zone in 2021, and -0.7 point of growth in the GDP of the United States”, adds Ana Boata, director of macroeconomic research at Euler Hermes.

Questioned a week ago by La Tribune, the minister delegate in charge of foreign trade, Franck Riester, said he had exchanged several times with maritime carriers such as CMA-CGM. "Despite the drop in world volume trade, there has been an increase in costs, in particular in connection with sanitary measures [...] Container shortages have contributed to increasing costs. We need a better understanding of transport measures For shipowners, there is a challenge in stabilizing the cost of maritime transport. Health constraints have had an impact. Companies are currently working on readjusting their capacities," he said.

> Read also: Foreign trade records its worst deficit since 2012

China takes the lead

The spread of the virus across all continents for more than a year has shaken global value chains hard. The extreme dependence of Western countries on China and Asian countries for critical products in particular has shed harsh light on the limits of commercial hyper-globalization pushed to the extreme. Some observers believe that this crisis could reshuffle the cards of global trade in the years to come if Europe and the States manage to relocate part of the production of certain products. It remains that the hegemonic ambition of China through the New Silk Roads remains a priority constantly reaffirmed by the authorities of the Communist Party. On the world trade chessboard, the Chinese giant, which recently signed a free trade agreement (RCEP) with its Asian neighbors, has been largely in the lead since the mid-2000s.

“Despite the pandemic, China as a production location and Chinese suppliers will continue to play an important role in global value chains, according to recent surveys. Some regionalization phenomena could take place but on limited segments in the short term [...] The Chinese economy has restarted earlier. This allows it to project itself more quickly into the post-covid period. The signing of this free trade agreement sends a strong signal on the position of the China on multilateralism. The impact on customs duties is smoother over time. The RCEP is the first multilateral agreement signed by China," the economist recalled.

Gregoire Normand7 mins

Share:

Samsung Galaxy S22, Uncharted et pl...

Tesla: you can now enjoy YouTube in...

EM – Butler vs Purdue Basketball Li...

Nantes. A child victim of an acci...