Frais réels ou déduction forfaitaire ? Lorsque les dépenses liées à votre emploi salarié sont importantes, vous avez intérêt à vous poser la question. Voici les éléments à prendre en compte pour aiguiller votre choix vers la meilleure solution fiscale. Avec cette année quelques nouveautés concernant le barème kilométrique et les frais de télétravail.

Your salary is subject to income tax after deduction of professional costs borne to receive it: home-work, catering, professional equipment, etc. They are assessed at 10% of your wages.But if your professional costs exceed 10% of income, you can rule out the flat -rate assessment and deduct them for their real amount.

The option for real costs is personal to each member of the tax household, each of whom can choose the most favorable scheme.It is possible to change it every year.

The flat -rate deduction of 10% automatically applies

Do not deduce 10% of your wages yourself, it is the tax services that apply the deduction.You have no proof of expenses to provide to benefit from it.

For the imposition of the 2020 income, the maximum deduction is set at 12,652 euros per employee.This corresponds to an annual salary of 126,562 euros.Conversely, the minimum deduction is 442 euros.For example, an employee who has worked only a month in the year for 2,500 euros in salary, will see his deduction of 442 euros instead of 250 euros.

The deduction to reality when your costs are significant

When your expenses exceed 10% of taxable income, you have an interest in excluding the flat -rate deduction by opting for the deduction of your professional costs for their real amount.You can deduct, in particular: home-work trips (justifying specific circumstances if the distance per journey exceeds 40 kilometers), food costs, professional equipment and premises, study and training costs, double residence…

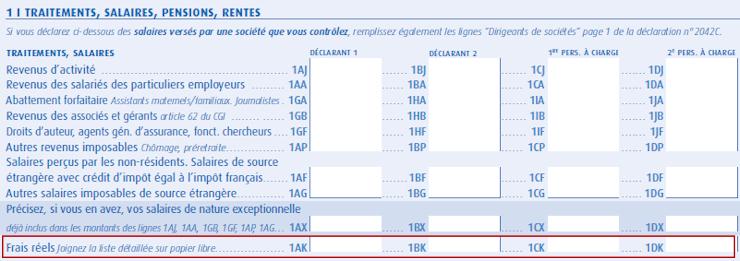

Just check the "Real Fresh Option" box in the online declaration and indicate the detail and the total amount of deductible fees in 1DK 1DK boxes.Without forgetting to reintegrate into your taxable remuneration the employment costs for employer.

Only your professional expenses are deductible

Expenses unrelated to your salaried obligations are not deductible: your children's childcare costs, for example (they can however benefit from a tax credit).Do not join supporting documents but keep your bills and costs for at least 4 years, to be able to meet any request for information from the tax administration.

The new features of the 2021 declaration

Même si vous optez pour les frais réels, vous pouvez évaluer forfaitairement certaines dépenses. Notamment, si vous utilisez votre véhicule personnel pour vous rendre au travail, vous pouvez déduire les frais réellement engagés, ou les évaluer forfaitairement à l’aide du barème kilométrique publié chaque année par l’administration fiscale. Il dépend de la puissance du véhicule (retenue dans la limite de 7 CV) et du nombre de kilomètres parcourus à titre professionnel dans l’année. Le barème 2021 est identique à celui de l’année dernière (il est reproduit dans la notice de la déclaration de revenus), mais il comporte depuis cette année un barème spécifique pour les véhicules 100% électriques, avec un bonus de 20% par rapport aux véhicules thermiques ou hybrides.

Another novelty, to take into account the health situation of 2020 and the development of telework, your related expenses can be subject to a particular evaluation: electricity, heating, furniture and desktop supplies type computer, seat, printer… The exemption is 2.50 euros per day of telework at home (50 euros for a 20 -day teleworked month).The flat -rate deduction limit is set at 550 euros per year.If this is more favorable to you, you can rule out this lump sum assessment and deduct your telework costs for their exact (and justified) amount.

Farewell Touch Bar, I won't regret...

Caddy, the only web server to use H...

Burkina Faso / Gabon (TV / Streamin...

What the future of work will not b...