Cryptocurrency mining is a hot topic. Many criticize the activity for its energy-intensive nature and generator of greenhouse gases (GHG), with bitcoin mining in mind. While Tesla Motors had been officially invested in bitcoin for a few months, its CEO, the naturalized South African Canadian billionaire Elon Musk, had, last May, cast opprobrium on the most famous of cryptocurrencies, bitcoin, by announcing no longer accept this means of payment for its automobiles as long as its production is dependent on carbon-rich fuels, in particular coal. Several facts then followed one another, including that of May 20 in the Financial Times, where the NGO Greenpeace also explained that it had given up collecting donations in bitcoin for ecological reasons and very recently the ban on mining in China, partly because that the activity did not fit with the ecological objectives that the country had set itself. All it took was a few simple tweets for the entire bitcoin universe to go into shock. All these facts have challenged cryptocurrency miners. Conscious of a world undermined by the ecological crisis, several efforts have been made. From proof-of-work protocol to proof-of-stake, through the choice of renewable energies.

Mining: energy-intensive and polluting

It is too important to remember that initially, the function of mining is to propagate and secure transactions and to copy them definitively in a decentralized digital register, public and accessible to all that is "the blockchain". A "chain of blocks", where the blocks would be like pages of a virtual accounting book that facilitates several hundred thousand transactions per day. In simpler terms, cryptocurrency mining is a process of solving complex mathematical equations in such a way as to validate the various crypto-transactions on a specific network. For each new cryptocurrency mined, the people who participated in its mining or, more simply, in the validation of a block, are rewarded with a determined quantity of this currency. The majority of cryptocurrencies on the market today have a limited number of tokens that will be released over the years, increasing in value as they become rarer. The main reason for the existence of cryptocurrency mining is to solve the biggest problem associated with these currencies, which is double spending.

Cryptocurrencies can be mined using three distinct types of computing devices: CPU (Central Processing Unit), GPU (Graphics Processing Unit or Graphics Card) or ASIC (Application-Specific Integrated Circuit), depending on the importance of the coin. investment you are willing to make. With so much competition in the mining industry, choosing one type of device or another depends on the cryptocurrency you plan to mine.

Cryptocurrency mining is practiced everywhere today and miners are free to adopt a business model that suits them according to the cryptocurrency they want to mine. They can opt for: “solo mining” or solo mining, that is to say mining at an individual level. Here the miner sets up alone with his equipment without any need to join other miners; "pool mining" or pool mining, in which several miners join a pool to increase the computing power of their server and thus increase their chance of finding the resolution of the complex mathematical calculation more quickly thanks to which a block will be validated. When a block is validated by a pool, the gain is shared by all the miners making up this pool according to the computing power provided by each. And finally. Cloud mining, which is the rental of an amount of computing power to a remotely located mining farm. In this way, a miner can participate in the mining of a cryptocurrency, without having the necessary equipment, which is very expensive and bulky. And today, it is also possible to carry out cryptocurrency mining using your mobile phone by downloading some applications that we will not mention to you unfortunately, because this process is so inadvisable. Indeed the life of your laptop, whatever its brand would be greatly reduced and with strong competition, mining with a phone may be an activity with zero return.

The profitability of cryptocurrency mining

The cryptocurrency mining sector has grown considerably and professionalized in recent years. Infrastructures hosting mining machines, called mining farms, are multiplying all over the world. The companies operating these "data centers 2.0" seek to optimize the profitability of their activities and establish themselves in geographical areas where the supply of electricity is greater than demand, because it is in this context that profitability is the more important. This type of energy is often renewable. For example, it comes from hydroelectric plants in Canada, or geothermal in Iceland and El Salvador. Energy storage solutions for producers are still complex and expensive today. The arrival of these new industrial players therefore represents a substantial financial windfall for these energy suppliers, who would not have seen all their production sold.

For individual miners who once could mine with just a personal computer (PC) in the corner of their room, the activity has become less profitable for them. Currently, it requires specialized hardware, huge amounts of electricity, so mining popular proof-of-work (PoW) type cryptocurrencies like bitcoin no longer makes it profitable for solo mining. unless, of course, you are a company willing to invest millions of dollars. However, lesser-known cryptocurrencies using the proof-of-stake (PoS) protocol still have great mining potential and can win you money if you get the timing right! Remember that there are other considerations to take into account before you start mining such as market price, block rewards, hash rates, possible upcoming halving, etc. The energy used nevertheless remains colossal on a planetary scale and we have observed for 3 years that a growing proportion of new blockchain projects are turning to the proof of stake consensus. Less energy-intensive, this technology has several notable advantages: faster transactions, less costly maintenance, etc.

Choosing a PoW or PoS Protocol in Mining

In the case of the "proof-of-work" protocol, or proof of work, implemented by the creator of bitcoin (the famous anonymous Satoshi Nakamoto), the creation of a new page of this digital register is conditional on the resolution of a cryptographic equation. This work of mathematical resolution is carried out by a specific machine, it is the “minor”. When the latter solves the equation necessary to continue writing the register, he is rewarded with 6.25 bitcoins. We are talking about the Bitcoin halving or the mining premium.

Although initially a simple computer was enough to mine bitcoin, today the more miners there are, the more complex the calculations. So there's no need to try to mine bitcoin with a simple desktop computer, the sector has become so competitive that miners now have fleets of hundreds of machines and chips dedicated to these calculations are now marketed: ASICs.

To maintain a place at the top, the biggest bitcoin miners have hundreds of machines, carefully maintained and constantly ventilated, to prevent them from overheating. It remains undeniable that the bitcoin network consumes electricity, like, each on their own scale, all cryptocurrencies. According to the University of Cambridge, which offers an index on its website to assess this impact, the annual consumption of bitcoin is currently estimated at nearly 115 TWh.

Despite everything said about this protocol, if you have the capital and are willing to put in the effort, bitcoin (BTC) continues to be the number one choice for cryptocurrency miners around the world. Its price is hovering around $51,448.28/BTC at the time of writing. In fact, not too long ago (last November), BTC hit an all-time high at over $57,000. Also be aware that the current reward for mining BTC is 6.25 BTC per block, this is the third halving since the inception of this cryptocurrency star in 2009, which will be reduced to 3.125 BTC by 2024. bitcoin is also much harder and more resource-intensive than mining most new cryptocurrencies on the market.

Note that there are several thousand cryptocurrencies, and hundreds are based on a protocol similar to that of bitcoin. This is, for example, the case of ether from the Ethereum network. Recognized for being at the forefront of innovation in the cryptocurrency industry thanks to its "smart contracts" and "dApps", Ethereum or ether is an extremely popular cryptocurrency that can still be mined (but not for long) . At the time of writing, the cryptocurrency market capitalization stands at over $448 billion. The current mining reward is 2 ETH per block. The network uses the Hash hash function and can be mined using CPU and GPU devices. Please note that although this network has upgraded to Ethereum 2.0 (ETH 2.0), thereby resulting in a change of consensus algorithm from Proof of Work (PoW) to Proof of Stake (PoS), miners still have to least two years to continue mining ether. The current ETH network will not transition to the PoS blockchain until ETH 2.0 phase 1.5.

On the Ethereum site, it is explained that you will have to stake 32 ETH (i.e. $131,399.2) of its value at the time of writing this article in order to be able to “participate” and try to become a validator. , i.e. the person in charge of mining the next block and checking the validity of blocks created by other validators. "The validators will be chosen at random", and it is specified that the cryptocurrencies put into play will be used to ensure the good behavior of the validators. According to an estimate by researchers from the University of Munich and the Massachusetts Institute of Technology (MIT) published in December 2020, the Ethereum blockchain would consume approximately the equivalent of 16% of the consumption of bitcoin.

The ZCash cryptocurrency, among the best known, also uses the protocol (PoS).

2016 saw the launch of several major cryptocurrencies, including Zcash (ZEC). Considering that developer company ZCash is privacy-focused, it stands out as an excellent cryptocurrency to mine. However, ZEC is not easy to mine despite its ASIC-resistant design. Nonetheless, the token provides an ideal mining opportunity for those willing to take a long-term approach. The current reward is 3.125 ZEC/block (or $524,562) its value at the time of writing this article and the money supply of the token is 21 million tokens, all to be mined by 2032. ZCash requires more RAM due to its Equihash algorithm.

Proof of stake, also called staking, consists in keeping digital assets on an electronic wallet (wallet) in order to participate in the security of a blockchain network and to be rewarded by the payment of interest. Some projects require a fixed quantity, which can be several thousand dollars and the lock period can vary from a few days to several weeks. This can therefore represent an important financial stake for the investor and it is precisely this "proof of stake" which makes it possible to obtain the confidence of the network by entrusting you with the validation of new blocks and therefore the payment of commissions for this work. accomplished.

Concretely, the wallet on which the digital assets are placed is connected to a computer server on which software and the entire blockchain register in question are installed. This link between assets and server is an essential condition for benefiting from interest: if one or the other of the conditions is broken, the system stops. It is therefore necessary to pay particular attention to the maintenance and updates of the server to ensure optimal availability. Most investors entrust this technical task to professionals specialized in this field.

It is also your responsibility to recognize the competition between proof-of-stake (PoS) and proof-of-work (PoW) cryptocurrencies. While it is possible today to generate income from the validation of transactions by the simple fact of staking tokens, some people would no longer like to mine. That said, it cannot be denied that mining, although more complicated, is more profitable. It all depends on the resources you are willing to invest.

As mentioned before, you can mine PoW tokens by being part of a mining pool, using an independent installation (with CPUs, GPUs and/or ASIC devices) or by renting computing power from a third party. Please note that if you choose to have your own installation, you will need to factor in electricity costs and the cost of updating hardware and software from time to time. The cost of electricity may vary from country to country. It is also the cheapest in Kazakhstan, Ireland, the United States, where a large majority of cryptocurrency mining is done today due to the production of the surplus electricity produced by these countries. New and experienced miners might consider using smaller cryptocurrencies, which are more cost-effective, as mining rig setup costs can also run up to a hefty amount initially for consumer hardware. Electricity costs vary depending on where the user lives. However, the biggest benefit of the activity is earning a token that could appreciate in value over time.

Efforts to neutralize the carbon footprint of cryptocurrencies

Some cryptocurrency creators have opted for supposedly greener protocols. Ether, the currency of the Ethereum blockchain, is still produced by mining, but its developers are working to transition to the "proof-of-stake" protocol, a protocol as opposed to the "proof-of-work" used by the star of cryptocurrencies, bitcoin.

As we have clearly underlined in the previous paragraphs, this protocol provides that to create additional blocks, a "validator" must prove the possession of a certain quantity of currencies and lock them. In exchange for this participation, he receives as a reward an interest proportional to the capital placed in sequestration, like a bank book. This protocol does not require more than a simple computer and an amount of currency. Proof-of-stake consumes far less power than proof-of-work, but the flip side is that it induces far more centralization.

As a result, until today, no alternative protocol has proven to be able to assume the same promises of a decentralized, public and secure cryptocurrency with negligible electricity consumption and carbon footprint as that of bitcoin, although he also strives to neutralize it. The green conversion of Ethereum has also been in the works for more than four years now due to technical difficulties. As Pierre Rochard assures us, if one day we manage to discover a proof-of-stake mechanism without negative compromise to decentralization and security, bitcoin users will adopt it. Remember that the bitcoin source code is open to everyone.

Faced with the many questions implied by the climate emergency, the players in this ecosystem are not insensitive. For Sébastien Gouspillou, co-founder of the mining company BigBlock Datacenter, this technology would even encourage people to completely abandon fossil fuels: “In Kazakhstan, I represent a godsend for the operator of the hydropower plant. He produces surplus, I consume it. For him, its cost is zero, ”he tells Le Monde. Like him, many miners have moved away from Chinese coal long before. And after the country made the decision to ban mining on its territory and to achieve carbon neutrality, bitcoin mining drastically minimized its dependence on fossil fuels.

The company Square, founded by Twitter creator Jack Dorsey, believes in an article published on April 21 that bitcoin could even become a source of financing for renewable energy infrastructure, including solar energy. “We are very much in demand by electricity producers and wind turbine builders, who realize that we are a windfall for their profitability,” says Sébastien Gouspillou.

A week after criticizing bitcoin for its carbon footprint, Elon Musk was pleased to have initiated a coalition of North American miners to make this energy transition. If some specialists already imagine this currency as the future of the international monetary system, the actors of this system will stop at nothing and will make every effort for the transition and the energy economy by prioritizing green energies more. Transition that all countries of the world are trying to implement.

Tesla CEO continues to take a keen interest in bitcoin. He met with representatives of several North American mining companies ready to be more transparent about the energy used by their activities. Elon Musk has not definitively turned his back on bitcoin, far from it. Even though he panicked the cryptosphere by announcing on May 18 that Tesla would no longer accept bitcoin payments, due to the environmental cost of the latter, the billionaire continues to take a close interest in it. A few days after his tweet, on Monday May 24, the CEO of Tesla had indicated in a new publication that he had met with several North American bitcoin mining companies ready to "disclose the share of renewable energy they use for their activities, as well as than their projections on the matter". According to the billionaire, this would be a “potentially promising” approach.

MicroStrategy CEO Michael Saylor gave The Verge a bit more detail about the meeting, revealing that Elon Musk met with representatives from crypto mining groups such as Argo Blockchain, Blockcap, Core Scientific, Galaxy Digital, Hive Blockchain Technologies, Hut 8 Mining, Marathon Digital Holdings and Riot Blockchain. He clarified on Twitter that these miners had agreed to form a Bitcoin Mining Council to promote energy transparency and environmental initiatives.

From mining to 100% renewable energies

Powering this activity with renewable energy would reduce the carbon footprint of bitcoin. But, in some areas, there is not enough renewable energy to supply all the existing activities, and there is a risk of conflicts of use. In which case, the fact that bitcoin uses so much energy may still be an issue, as most skeptics believe. For them, the consumption of cryptocurrency risks forcing certain groups with other activities to continue to use fossil fuels. Should we remind them that until the time of writing this article, several producers continue to lose surpluses unnecessarily due to a lack of storage? However, it will be necessary to see with use whether these new systems are robust and above all resistant to cheating attempts. The main risk for a cryptocurrency is indeed that some miners manage to distort the blockchain in order to fraudulently appropriate coins.

Other possible side effects should also be taken into account

Proponents of bitcoin, inspired by the libertarian current, believe that cryptocurrency can be a new store of value, if not a safe haven like gold, and that it allows to bypass intermediaries like banks thanks to its decentralized mode of operation. "Whether bitcoin's carbon footprint is a problem or not depends on its value to society," Jonathan Koomey, a Stanford University professor specializing in finance and energy policy, told Heidi.news.

But in any case, the question would not even arise since cryptocurrency would support the development of renewable energies, according to Sébastien Gouspillou. “We only use wasted megawatts,” he says of his mining company, BigBlock Datacenter. Mining is the process by which transactions are validated and recorded in the blockchain. In summary, specialized processors, ASICs, are running at full speed to solve as efficiently as possible a very complex mathematical operation to secure the network. It is the power supply of these machines that requires a large consumption of electricity. But if this electricity is composed solely of surpluses produced by renewable energies that would otherwise remain unused, the question of the carbon footprint of bitcoin no longer arises. This is the argument put forward by Sébastien Gouspillou, whose startup exiled its machines to mine in Kazakhstan, near a hydraulic dam, before opening another mining farm in the Democratic Republic of Congo, near a hydroelectric power station.

“Without bitcoin, the price of surplus renewable energy would be zero”

A way for the French entrepreneur to go where electricity is sold the cheapest. But also to get closer to the production of renewable energies to directly recover the surpluses. "We are customers of last resort: we need very little infrastructure, no road or port... So we are the only ones who can recover our lost megawatts", argues Sébastien Gouspillou in the amphitheater of the Casino de Biarritz, where "Surfin' Bitcoin" took place.

El Salvador, the first state in the world to consider bitcoin as legal tender, called on its startup to develop mining activity. “They have 10% excess electricity that they don't know how to distribute, which represents 20,000 bitcoins mined a year. We buy electricity ten times cheaper than the local population. We are going to help develop green energy in El Salvador by using the surpluses,” says Sébastien Gouspillou.

“Bitcoin is a real asset in the ecological transition. Without bitcoin, the price of surpluses produced by renewable energies would be zero,” insists Pierre Noizat. "Bitcoin allows the creation of a floor price which encourages financing of projects around new energies", he adds. It is a real ecological operation towards 100% renewable to reassure on the environmental impact of cryptocurrency. "There may be surpluses and a problem of adequacy between supply and demand for electricity", confirms Anne Boggione, business manager at Naldeo technologies, an engineering group specializing in ecological transition.

Although there are solutions for storing surpluses, it depends on the network, when it is sufficiently developed, as in France and Europe. Or the retention of water by dams, upstream of the production of hydroelectricity. Finally, battery storage is growing more and more. "We can store but up to a certain point," retorts Pierre Noizat, believing that there will always be surpluses. “Bitcoin mining is one of the answers to establish a floor price,” he continues.

And if many miners use surpluses to pay less for electricity, they are certainly pursuing a crusade that will lead to the use of all renewable energies. Several studies have followed one another and now allow anyone who wants to assess the share of energy from multiple sources as well as that of hydroelectricity in the global mining industry. Based on the results of a survey published on July 1, Bitcoin Mining Council (BMC), estimates that 56% of global mining is done using renewable energy. Certainly, in addition to the energy used, mining would operate up to a million machines (ASICs) in the world. According to Sébastien Gouspillou, "it's a drop in the ocean compared to the quantity of smartphones manufactured", which number in the billions on the planet. "It's a sector where there is no planned obsolescence, with machines that are more than five years old and still working," he adds. It remains to set up a recycling channel for these ASICs, manufactured in particular in China. And for the crypto community, to convince the general public and political leaders that bitcoin is a solution for the future, both financially and environmentally. More surprisingly, last September, Nayib Bukele, President of El Salvador announced on his Twitter account the start of bitcoin mining from electricity produced by a geothermal power plant from the Santa Ana volcano. At this pace, nothing more is to be feared, the great march towards 100% green has begun and nothing will stop the efforts.

Written by Guellord Mbusa for Cointribune.

AARedition TCTBehind the generic signature "TCT Writing" are young journalists and authors with specific profiles who wish to remain anonymous because they are involved in the ecosystem with certain obligations.

SOS Public Hospital: our revelation...

The best smartphones for gaming in...

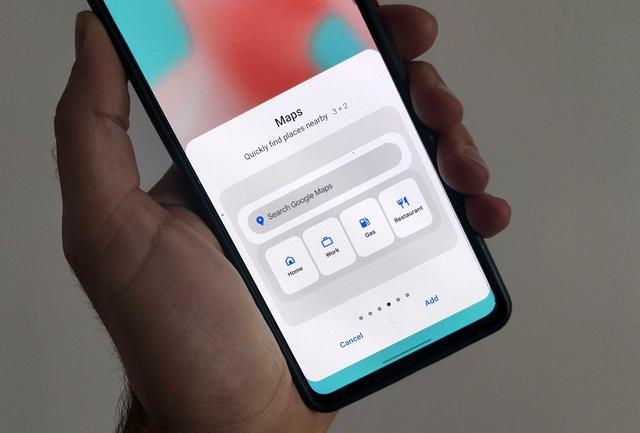

Google Maps: activate the new widge...

Free tips in video: Free Mobile off...