From one supplier to the other, the practices in terms of payment methods differ greatly.Some actors will not make gifts, while the most flexible will offer to pay up to ten times free of charge.Other actors even offer to use a monthly payment system, according to a process similar to that used by the Treasury.

What are the payment methods available for fuel oil?

As a rule, domestic fuel oil suppliers favor payment at once by:

However, the cost of a fuel oil delivery represents a substantial budget and it is sometimes difficult for households to pay the invoice counting.This is why some distributors now offer the Fioul payment order in several times.However, this service is not always free.

How is the Fioul Payment Mensualized Payment?

Generally, as part of the monthly payment, the first delivery is made only after payment of an amount greater than or equal to half the value of the fuel oil that the customer wishes to order.The amount of the samples is usually estimated on the basis of annual consumption: withdrawal = (annual volume consumption x price of fuel oil) / 10.

At the end of the period, depending on past consumption and variations in the price of fuel oil, an adjustment or refund will be made in order to bring the balance back to zero.It is a process similar to that suffered by monthly taxpayers.In case of extreme cold, we can expect an upward adjustment, due to the increase in consumption.

Fioul delivery payment in several times: is it free of charge?

Generally, a monthly payment fuel payment has additional costs that increase the price in the liter of fuel oil.To be sure to pay for your cheaper fuel oil, it is therefore recommended to anticipate your orders and program them during off -peak periods (in summer for example).In addition, we must follow the evolution of the price of fuel oil regularly because it is linked to that of oil.

The table below gives some examples of the costs linked to a fuel oil delivery with payment facilitates according to the suppliers.

| Fournisseur | Paiement en plusieurs fois | Frais supplémentaires |

|---|---|---|

| Fioulmarket.fr | Carte bancaire en 3 fois | +10€ sur la commande |

| Carte bancaire en 4 fois | +20€ sur la commande | |

| Fioul Cdiscount | Carte bancaire en 3 fois | +15,82€ sur la commande |

| Carte bancaire en 4 fois | +23,21€ sur la commande | |

| Fioulmoinscher | Seulement si accepté par le distributeur | Varie selon le distributeur |

| Fioulreduc | Carte bancaire en 3 fois | +14,39€ sur la commande |

| Carte bancaire en 4 fois | +21,10€ sur la commande | |

| Carrefour | Avec la carte PASS en 3 fois | Sans frais |

| Auchan | Indisponible | NA |

| TOTAL Proxi Energies | Mensualisation | NC |

| Paiement en 3, 4, 6 ou 10 mois | Intérêts sur le crédit | |

| AVIA Thevenin Ducrot | Carte bancaire en 3 fois | +0,01€/litre de fioul |

| Mensualisation | 25€/an réparti sur 11 mois | |

| Bolloré Energie | Mensualisation | NC |

Mentalizing his invoices as for electricity through tank gas, the Customer signs a contract with a propane supplier.This allows him to be delivered regularly in gas and to be able to stagger his payments.For example, Butagaz has set up the ecoconfortic pack which makes it possible to pay a fixed monthly payment throughout the year to avoid paying a large sum with each delivery.To obtain a personalized propane quote, it is advisable to call on Selectra experts on 09 74 59 33 30 or to make an online request.

What other assistance with fuel oil invoice can I get?

Apart from the Fioul payment facilititis, there are aid aimed at reducing household expenditure in fuel oil consumption.This is the case, for example, of the energy check which makes it possible to finance energy renovation work or to pay its fuel oil bills when the home has modest income.

Use the energy check to pay for your fuel oil bills

Unlike the social tariffs of energy, the energy check does not apply solely to gas and electricity, it is therefore quite possible to pay your fuel oil bills with this aid.Several criteria must however be met to be eligible for the energy check:

If the home meets all the criteria, he will receive his energy check towards the end of March by post which will be valid for 1 year.No request is to be made, the amount of the check varies depending on the home income and the number of people composing it.Then, to pay by energy check, the customer must get closer to the supplier who will explain him the procedure to follow.Some make it possible to pay in energy checks on delivery directly with the delivery man and others ask their customers to send them by post in order to deduct it from their invoice.

Deduce his fuel oil invoices from his taxes

In some very precise cases, the fuel oil invoices can be charged and therefore come and reduce taxes payable.This is particularly the case for companies that control fuel oil for their direct (fuel oil feeding an oven or an engine/generator) or indirect (fuel oil for the heating of administrative and industrial buildings).The company then recovers the VAT included in the sale price, and passes the amount of the invoice as a charge in its income statement.Company tax being based on net profit (= turnover - charges), fuel oil invoices thus reduce the tax payable.

Be careful however, in the specific case of SCIs, fuel oil invoices (just like those of electricity, natural gas and water) are not deductible.Indeed, these are charges incumbent on the tenants, even if they are sometimes advanced by the lessor.On the other hand, the reimbursements of these expenses by the tenant to the owner are not taxable.Advances and reimbursements are neutral both at the cash plan and tax plan because they pass through third -party accounts.

Finally, fuel oil invoices are not deductible from income tax, even having opted for the declaration of professional costs to the real.Indeed, to be deductible, these expenses must meet the following criteria:

SOS Public Hospital: our revelation...

The best smartphones for gaming in...

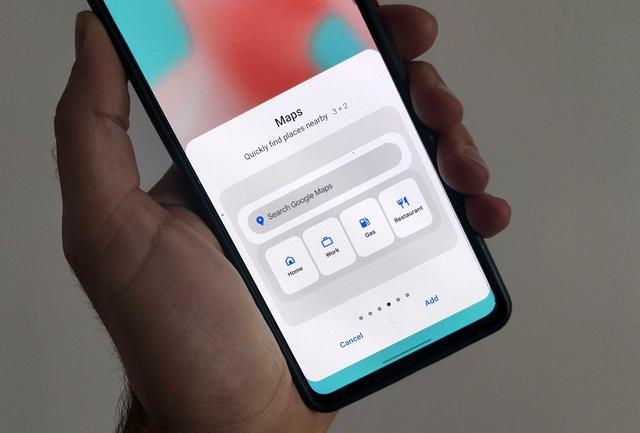

Google Maps: activate the new widge...

Free tips in video: Free Mobile off...