The Belgian telecommunications regulator IBPT (Belgian Institute for Postal Services and Telecommunications) published in December 2021 a comparative study of the prices of telecom products relating to the following countries: Belgium, Germany, France, Luxembourg, the Netherlands and the United Kingdom.

Two significant paintings

Ranking of countries according to their price level for mobile services (from the cheapest to the most expensive)

High prices for Luxembourg

The study is based on the tariff plans collected in November 2021 in the different countries. It shows that the prices of telecom services in Luxembourg are rather high compared to the other countries analyzed.

Thus, for mobile profiles with a high volume of data and voice, Luxembourg is among the two most expensive countries. However, this observation must be qualified because the prices for mobile profiles of average and basic consumption with a monthly data volume ranging from 5GB to 0.5GB are more competitive in Luxembourg than in other countries.

For consumers who use multi-service bundles (a combination of Internet, TV and fixed and/or mobile telephony services), prices in Luxembourg are rather high.

Conversely, for fixed Internet consumption profiles at 200Mbps, the consumer pays less in Luxembourg than in other neighboring countries.

In general, this analysis confirms the results of previous studies published by BIPT, namely that Belgium, like Luxembourg, is regularly among the three least competitive countries.

Comparison: let's take some examples

Comparison between price level and degree of competition for mobile services

Comparison between price level and network quality for mobile services

Comparison between price level and degree of competition for fixed broadband Internet services

Operators with national or regional access coverage:• France: Orange and cable activities of SFR• Germany: Deutsche Telekom and Vodafone• Luxembourg: Post Lux and cable activities of Luxembourg Online• Belgium: Proximus and Telenet in Flanders, and Proximus and Voo in Wallonia

Groups in Luxembourg and in neighboring countries

“Prepaid”: a German market

With regard to the German market, another notable feature should be underlined: the importance represented by the “prepaid” customer base compared to the other countries analyzed in this report.

Indeed, this prepaid customer base accounts for 33% of all mobile customers in this country, a figure much higher than that in force in other countries, as shown in the graph below (10-11% in France and in Luxembourg and 17-18% in Belgium and the Netherlands, with only the United Kingdom passing the 20% mark).

Please note: The German prepaid subscriptions included in the study are all price plans where the contract is billed monthly or every four weeks and automatically renewed. In this sense, they are much more like “full control” postpaid subscriptions in Belgium than prepaid cards that can be paid once and topped up whenever you want.

4G and 5G coverage

The delay that Belgium has taken in the auction of 5G licenses penalizes it. Thus, from 6th out of 28 in 2017 in terms of mobile broadband, Belgium now finds itself 21st out of 27 in 2021, while the Netherlands, Germany, Luxembourg and France are respectively 2nd, 4th, 13th and 15e and are already marketing (to varying degrees) 5G services.

Read Top 5 reasons to hope for the end of the epidemic for 2022

Read It costs more and more to build in Luxembourg

Find us on Instagram

SOS Public Hospital: our revelation...

The best smartphones for gaming in...

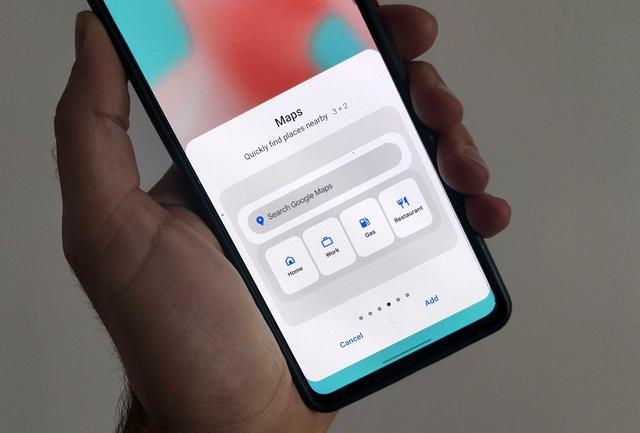

Google Maps: activate the new widge...

Free tips in video: Free Mobile off...