Lyf is a French Fintech, leader in augmented mobile payment that allows you to centralize all your payments on a single application. Launched in May 2017, it has now exceeded 4 million downloads. Lyf supports large retailers and independent professionals in the digitalization of their customer relationship as well as in the fluidification and diversification of their purchasing journeys.

Today we welcome Christophe Dolique, CEO of Lyf, to tell us more about this application. We mention in particular his career, the competitors of the application and his ambitions for 2022!

Interview with Christophe Dolique, CEO of Lyf

JUPDLC: Can you introduce us to Lyf in one sentence?

Christophe Dolique: Lyf is the 1st French fintech to simplify payment and reinvent everyday purchasing paths thanks to mobile. Our super APP Lyf Pay always integrates more innovative and secure services to simplify the payment and shopping experience of nearly 2.5 million users.

Lyf also supports major retailers and independent professionals in the digitalization of their customer relations as well as in the fluidification and diversification of their purchasing journeys.

JUPDLC: What is your background? How did it lead you to found Lyf?

Christophe Dolique: I have been working in mobile for more than 20 years now, in France and internationally. I had the opportunity to build my career in very different companies: first IBM and Philips Business Communication, where I participated in the development of mobile and smart cards in the Asia-Pacific zone. I then co-founded the company Mobile365 which has become the world's leading operator of SMS/MMS services (messaging, alerts, ringtones, games, etc.). After that, I managed strategy and marketing for the Telecom division of Gemalto, then held the position of Executive Vice-President of Ingénico, in charge of strategy, products and new transactional services.

On the strength of these different experiences, I started this project, which became Lyf in 2017, based on the observation that the mobile phone was going to revolutionize our daily lives, change our behavior and consumption habits completely, and lead to the development of a new ecosystem. And the intuition was right!

JUPDLC: What is your offer?

Christophe Dolique: Today's consumers want omnichannel, immediacy, autonomy, tailor-made. Faced with these new expectations, we have built a suite of mobile solutions to help the Retail ecosystem meet these challenges.

Today, our mobile solutions, whether intended for the general public or professionals, improve the customer experience by eliminating in-store irritants, first and foremost waiting at the checkout or in the restaurant. They also make it possible to offer new, innovative purchasing paths, but also to develop commercial performance, by facilitating the collection of qualified data, in compliance with regulations and user choice.

The cornerstone of our solutions is the Lyf Pay app, which has over 4.5 million downloads and 2.3 million users. The Lyf Pay application is a free and secure mobile payment wallet that simplifies the payment and shopping journeys of its users on a daily basis. Everyone can register their means of payment (bank cards, restaurant vouchers card, etc.) and their loyalty instruments (loyalty cards, coupons, etc.) to then:

Today, Lyf services are accessible to everyone in more than thirty national brands:

We are also deploying among independent professionals and, since 2021, in the catering sector.

Podcast

JUPDLC: What is augmented mobile payment? And how do you stand out from your competitors?

Christophe Dolique: We have two convictions, which reflect our particularity and our unique positioning.

Firstly, we are convinced that payment, if it is at the heart of everything we offer, is only differentiating if it is "increased", enriched with many other services, which make the act of purchase more fluid and simplify the life of the user. The Scan & Go, for example, obviously includes a payment phase, but above all it offers upstream, an in-store user experience that has nothing to do with a traditional journey. It allows you to save time, to be more autonomous, to combine the best of the web and the best of the physical store and, above all, to no longer wait at the checkout.

Secondly, we are convinced that to become a "super app", one of those used almost daily, we must bring together in one and the same place a real diversity and a wealth of services relating to payment and everyday purchases. It is in this way that we will be the most relevant for our users on a daily basis and that our solutions will be used, and reused, with great frequency.

In this hotly contested market for mobile payment applications, we have opted to offer an all-in-one application that covers all aspects of payment and purchasing. A great App in short! Finally, I would add that we are a French company, whose entire activity, from developers to customer service, is based in France and meets French and European regulatory requirements in terms of data protection and security. financial transactions.

JUPDLC: Who are the main users of the application? Young people ?

Christophe Dolique: The average age of our user is 35 years old. However, our services are intended for users of all ages: as much for a 21-year-old student who wants to pay for her drinks in cashless, during a festival, as for her brother who is reimbursed by his friends, as for his 52-year-old father who no longer wants to wait at the supermarket checkout.

JUPDLC: Your application now has more than 2 million users. What are your ambitions for the years to come?

Christophe Dolique: Our ambition is to become a French – and why not European – Super APP integrating ever more services, and adopted by ever more users, we hope! We are indeed convinced that the future lies in the development of solutions that will provide access, via a privileged and contextualized entry point thanks to the smartphone, to a wide variety of payment and purchasing services, with ease and security.

To learn more about Lyf, go to its dedicated tool page!

Lyf tool page

SOS Public Hospital: our revelation...

The best smartphones for gaming in...

Free tips in video: Free Mobile off...

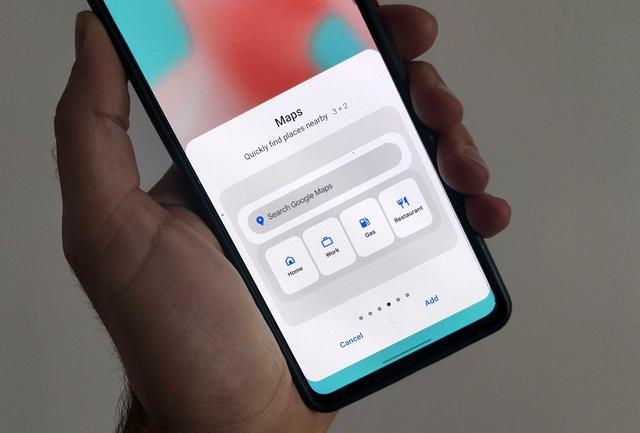

Google Maps: activate the new widge...