Advertising Insurance

Whose fault is it: to the seller who was not clear or to the customer who signed without understanding? To the seller, the mediation body considered: "one may well question, on the one hand, the actual delivery of the documents to the subscriber, and, on the other hand, the quality of the information provided by the seller of the principal asset". UFC-Que choix filed a complaint in 2018 against the SFAM broker and its then distributor, FNAC, for misleading business practices on their mobile insurance products. Arnaud Chneiweiss calls for better training for sales people proposing the contract, but also for an extension of the withdrawal period to one month.

These situations, which are already costly and a source of litigation, may even take on a whole new dimension. "many of the testimonies we have received refer to forced sales," says the mediator. The procedure is simple, but efficient: the seller, claiming that his employment is at stake, asks the individual to take out the insurance. Promising, by the way, that the latter could be terminated after one month. Problem: the legal time limit is 14 days and the client becomes engaged over a period of time unintentionally. "in law, this is called scam," insists Arnaud Chneiweiss.

>> Notre service - Faites des économies avec nos comparateurs de forfaits mobiles

Will it be easier to refer the matter to the Ombudsman?

In the face of this situation, the insurance mediation has on many occasions asked the companies named in the testimonies, as well as the Fédération des Garanties et assurances affinitaires (FG2A). No success. "what does it take to be heard? "name and shame?" asks Arnaud Chneiweiss. Behind this anglicism ("naming and blaming" in French) lies a practice of denouncing breaches through a public communication to encourage compliance with the regulations, and by the way, attack the reputation of the company "it is inconceivable that professionals should not realize that this practice seriously harms their image," he continues.

Unfortunately, there are not many solutions for insured persons who are victims of deceptive practices. The 2019 law on the modernisation of the justice system requires them to try mediation for disputes under 5,000 euros, before referring them to the courts. Following the publication this summer of the report of the Financial Sector Advisory Committee (FSC), a reform of the mediation process is also under way to make life easier for individuals. "the ball is in the court of the Supervisory and resolution Authority," the mediator sums up. The Insurers' Constable should be in charge of drafting new regulations.

>> Notre service - Résiliez vos abonnements et contrats en ligne, simplement et en toute sécurité, avec envoi automatique de votre lettre en recommandé

A long-standing requirement of consumer associations, the main measure is to introduce a time limit for seizure two months after the "first written expression of the insured's dissatisfaction with his insurer or broker". Whether it's oral or written, then. This may seem a long time, but it is in fact a step forward, because at present, the procedure for reaching mediation looks like a combatant's course. According to the principle of "escalation", the client must contact an advisor, then the company's complaints department, before finally being able to refer the matter to an amicable settlement body. This is a welcome simplification, but it raises the question of the explosion of referrals registered by the Ombudsman, and the ability of the Ombudsman to be able to meet the expectations of households.

SOS Public Hospital: our revelation...

The best smartphones for gaming in...

Free tips in video: Free Mobile off...

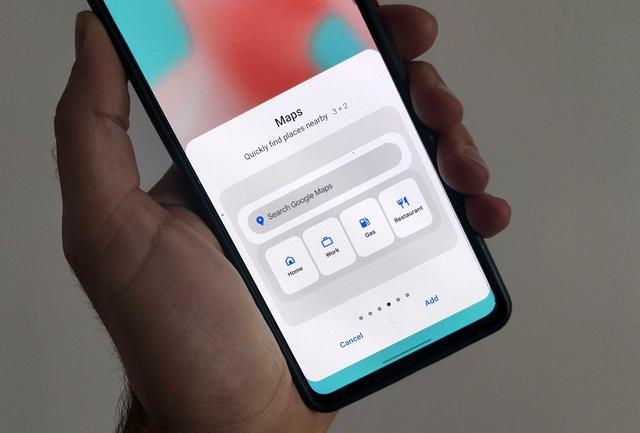

Google Maps: activate the new widge...