Salary indexation for some 400,000 employees

The salary indexation of CP 200 employees, the country's largest joint committee, could reach 3.56% on January 1 2022, according to the latest calculations from SD Worx published at the end of November.

Some 400,000 employees (nearly 50,000 employers) in the private sector are affected.

Such indexing would be unheard of for a good ten years. The exact figure will be known at the end of December.

Automatic indexation in Belgium is a mechanism that allows salaries to be adjusted according to the cost of living. It is supposed to dampen inflation.

> Find out here if your salary will be indexed, and if so, how high.

Ecocheques can be used for all farm products

As of January 1, ecocheques can be used to purchase all products sold by farms that hold the “Live Direct” label. from the farm" and not only those certified "organic". The decision was taken within the National Labor Council, which brings together the social partners.

In order for their consumers to be able to spend their ecocheques, farms must have the “Direct from the Farm” label and be affiliated with a company issuing the checks, specifies the FWA.

These ecocheques, intended to promote the purchase of ecological products, could already be used to buy products on farms, but only those that were certified “organic”.

Better conditions for the reimbursement of certain painkillers

The Royal Decree of 3 June 2007, which provided for reimbursement of 20% of the price of certain analgesics for patients suffering from chronic pain, is repealed in January 1, 2022 in favor of Chapter IV of the list of reimbursable medicines which guarantees patients better reimbursement conditions for these medicines.

Since the entry into force of the Royal Decree, several analgesics based on paracetamol have been included on the list of reimbursable medicines, in particular for the treatment of chronic pain. There were therefore two different circuits for the reimbursement of these drugs.

Increase in maternity benefits for the self-employed

The self-employed now benefit from an increase in maternity benefits for weeks of rest starting no earlier than January 1, 2022.

For the first four weeks of maternity leave, the amount reaches up to 752.34 euros in the event of full rest and 376.17 euros in the event of half-time rest. From the 5th week, it can go up to 688.12 euros in the event of full rest and 344.06 euros in the event of half-time rest.

The tax authorities withhold less withholding tax

The tax authorities have withheld less withholding tax since January 1 and therefore reimburse less tax.

Employers withhold an amount each month from their workers' wages as withholding tax, a form of advance payment for the final calculation of tax at the end of a tax year.

Over time, this withholding tax has ended up distorting the value of the net salary since each year the tax authorities must reimburse large sums to taxpayers subject to the withholding tax.

Next year, the reform will result in an average "increase" of 128 euros per year in net wages, 209 euros in 2023 and 243 euros in 2024. On the other hand, taxpayers will receive a lower tax refund.

Loss of benefits in the event of non-payment of the mutual contribution for two years

People who do not pay their mutual contribution for more than two years lose their rights to additional benefits from their mutuality . This suspension has been legally provided for since 2019 and affiliates have been excluded since January 1.

To enjoy the benefits again, affiliates must first pay their membership dues for 24 months.

Diesel and petrol company cars taxed more heavily

As of January 1, taxes on diesel and petrol company cars have been increasing. The taxable benefit of these cars increases due to the annual adjustment of CO2-references, the average emissions of newly registered cars.

People with a company car with which they travel both professionally and privately benefit from a taxable benefit. It is calculated on an annual basis and the percentage of CO2 emitted is taken into account.

Due to the drop in average CO2 emissions in Belgium, in particular thanks to the "greening" of the vehicle fleet, the references have been adjusted. For petrol, natural gas and LPG cars, the reference emission drops from 102 to 91 grams of CO2 per kilometre. For diesel cars, it decreases by 84 to 75 grams of CO2 per kilometer.

These reductions mean an increase in the percentage of CO2 from cars that emit more, and therefore an increase in the taxable benefit.

The minimum taxable benefit for 2021 was 1,370 euros per year and will be indexed in 2022.

Stamps are more expensive

The price of stamps has been more expensive since this Saturday, January 1, 2022. The Non Prior postage stamp, purchased by the piece, goes from 1.10 euro to 1 .19 euro. The Prior postage stamp sees its unit price increase from 1.60 euro to 1.89 euro.

Furthermore, the postage rate for a standardized item sent to Europe is 2.09 euros for the purchase of at least five postage stamps and 2.23 euros for a single purchase.

For items sent outside Europe, the international rate is 2.31 euros from five postage stamps and 2.45 euros per unit.

Proximus and Orange are increasing their prices

Proximus customers who have old internet-television-telephone packs and Orange customers, for fixed internet and television, pay more for their subscription since January 1, 2022 (Proximus) and) from January 17 (Orange). On the other hand, Telenet has not planned to increase its prices after having increased them in the summer of 2021.

Read alsoBad news for Proximus and Orange customers: prices will increase from 1 January

Proximus customers with the “Minimus” and “Familimus/Tuttimus” internet-television packs pay 1.5 euro more per month, to reach respectively 62.5 and 73.5 euros per month. For packages with landline telephony and television, landline telephony and internet and “Start” (landline telephony, internet and television), the monthly rate increases by 1 euro. These packs are no longer available to new customers or are no longer actively promoted. The amount of the Flex packages remains unchanged.

In addition, the operator increases the price of all Internet subscriptions outside bundles by 1 euro per month for individuals and those with a Proximus fixed line that is not part of a bundle will pay 0.5 euro moreover.

Finally, the price of a second decoder also increases, going from 6 to 8 euros per month, just like the TV Replay+ product, which goes from 5 to 6 euros per month. Prices for mobile subscriptions remain unchanged.

At Orange, the prices of the Love, Home and Boost offers are adapted. For services including fixed Internet, the increase is 2 euros per month, and for those including fixed Internet and television, the increase is 3 euros per month. All other prices remain unchanged.

Euro 4 standard diesel vehicles can no longer drive in Brussels

The Low Emission Zone (LEZ) in Brussels took a new step on 1 January with the ban on standard diesel vehicles Euro 4 to reduce air pollution.

These cars, vans, buses and minibuses can no longer travel within the LEZ, which covers the 19 municipalities of Brussels. Approximately 76,500 vehicles aged 11 and over, registered in Belgium and circulating in the Brussels Region, are concerned (including 25,000 registered in Brussels).

According to Brussels Environment, this is the latest generation of diesel vehicles that should not be equipped with a particulate filter. They therefore pollute more and emit large quantities of fine particles.

A transition period is planned for three months until April 1, 2022, the date from which drivers in violation will receive a fine of 350 euros.

Brussels Environment expects a significant effect. According to a study that evaluated 130,000 different vehicles in real conditions in the capital, Euro 4 diesel cars were responsible for almost half of the particulate emissions measured at the exhaust and a quarter of the nitrogen oxide emissions even though they represented only 12% of the vehicle fleet tested.

According to the European Environment Agency, air pollution causes approximately 9,000 premature deaths each year in Belgium, including 1,000 in Brussels, as well as cardiovascular and respiratory diseases.

A universal banking service to maintain manual operations

A universal banking service (SBU) has been included in the offer of Belgian banks since January 1, 2022 so that customers can pay and manage their money without difficulty in the context of the digitization of society. “It is necessary to pay particular attention to the group of less or non-digital people”, underlines Febelfin, the Belgian federation of the financial sector.

Several banking institutions already offer packages including a sufficient number of manual operations at a reasonable price, but this offer will be extended to most retail banks thanks to the SBU.

The universal banking service provides a package of services comprising at least 60 manual transactions per year (in particular paper transfers to be submitted to the branch and cash withdrawals at the counter), a debit card, 24 cash withdrawals at the the bank's ATM, and the printing of account statements at the bank's own ATMs in the branch.

The SBU has a maximum fixed cost of 60 euros per year, possibly supplemented by a variable cost for sending account statements.

Rate increases planned in several banks

Banks are increasing the rates for certain banking services on January 1st. These increases concern in particular basic bank accounts but also the sending of statements by post.

At BNP Paribas Fortis, the monthly fee for the basic current account (6% of customers) goes from 1.75 to 2 euros, and from 7 to 7.75 euros for the Premium Pack (one to three accounts, 23% of customers).

Fintro, a subsidiary of BNP Paribas Fortis, has reduced the monthly fee for maintaining an ordinary current account from 1.75 to 2 euros. The standard subscription for the "Fintro Blue Sky" pack also costs 7 euros per month, compared to 6 previously, and that of the "Fintro Blue" 3.5 euros per month instead of 3. The age limit for benefiting from the Go-Life account is also reduced from 30 to 27 years.

Read also142 new “Batopin” cash dispensers announced in Belgium and up to 2,240 for 2024, but there will not be any in all municipalities!

The Axa bank has planned, it , an increase in the sending of account statements by post. Excluding shipping costs, monthly sending for current accounts now costs 5 euros (no costs previously), 30 euros for a weekly frequency (instead of 17 euros) and 50 euros for a daily frequency (25 euros previously). The monthly withdrawal from the bank agent increases from 50 to 75 euros. Regarding savings accounts, without postage, sending home statements goes from 2.5 to 5 euros regardless of the frequency. It costs 25 euros (against 15) via the agency.

An additional Axa card reader also costs 25 euros instead of 15.

At Deutsche Bank, the quarterly fee of 12 euros for the "DB account" becomes a monthly fee of 5.30 euros per month. However, it is not due if the clients are under 25 years of age, if the total value of assets (cash, investments including insurance products) is at least 50,000 euros or if they also benefit from “DB Personal” or “Private Banking” services.

For Bpost Banque, the price of the “b.comfort” account has gone from 4.25 to 4.50 euros per month, and that of the “Postchèque” account from 24 to 28 euros per year. The cost of sending account statements (postage per envelope) is also slightly more expensive, at 1.8 euros compared to 1.7.

Crelan had also announced price increases: from 4 to 4.50 euros per month for the Economy Plus Pack (free for those under 24), from 3 to 3.50 euros for the same pack used by cooperators, from 24 to 30 euros per year for the current account.

ING is also making its Green Account a universal banking service that guarantees affordable services for non-digital customers. Since today, sixty manual debit operations per year are included in the service, with a cost of 1 euro from the 61st operation.

The “maximum to be billed” ceiling in healthcare has been increased to 250 euros

Since January 1, the “maximum to be billed” ceiling (Màf) in healthcare, for people with the lowest incomes, is reduced to 250 euros against 450 currently.

This decrease concerns more than 96,000 households, who can now count on a higher reimbursement thanks to this lowering of the ceiling to 250 euros. In concrete terms, families with the lowest incomes, who have accounted for 250 euros in co-payments for health care, are reimbursed for the rest of the third-party payment during the same year.

The move from this maximum to charging the lowest at 250 euros was endorsed in October in the 2022 health care budget by the general council of the Inami. The government has meanwhile validated this lowering of the lowest ceiling. The measure is part of a series of reforms included in the program law, which was approved at the end of December in plenary.

Reintroduction of end-of-career time credit with allowances

Workers on end-of-career time credit can again benefit, subject to conditions, from a right to Onem allowances before the age of 60.

The collective labor agreement (CCT) concluded within the National Labor Council (CNT) reintroduced this right which had disappeared on December 31, 2020. It is again accessible for the period from January 1, 2021 to June 30 2023.

Working 4/5th time or part-time with an allowance is therefore possible from the age of 55. To benefit from it, workers must prove a career of 35 years, have worked in a heavy trade for 5 years in the last 10 years or for 7 years in the last 15 years, have done night work for 20 years or work in a company in difficulty or undergoing restructuring.

The tax authorities will have access to the amounts in Belgian accounts

As of today, banks operating in Belgium must communicate the balance of bank and payment accounts as well as the aggregated amounts of certain financial contracts two once a year to the Central Contact Point for Financial Accounts and Contracts.

The objective is to help in the fight against fraud. The tax authorities can actually more easily consult the balance of a bank account in the event of suspicion of fraud or money laundering.

“The first communication of the aforementioned global balances and amounts must be made no later than January 31, 2022,” the National Bank specified on its website.

The Ministry of Privacy, a Belgian association campaigning for the protection of privacy, seized the Constitutional Court in June because the measure, according to it, violates bank secrecy. A decision is expected in 2022.

The simplified energy bill

The energy bill has been simpler and clearer for the consumer since 1 January 2022. A royal decree now establishes the minimum requirements that bills and billing information for gas and electricity.

Find out more aboutGas prices on the rise: “No improvement expected before the end of winter”

By Laurence Piret

Journalist in the General Editorial Department

THE MEUSE Liege |

The geopolitical situation and higher consumption due to winter temperatures are once again worrying the market. As a result, prices are rising again: nothing good for our wallet!

Click here to discover the article on LaMeusePresented on two pages, the information is divided into five different sections to clearly identify them: "Essential information on the contract", "What, where and how should I pay or recover an amount", "I have a question", "Compare contracts and change" as well as "Manage your energy consumption". “Fine print” will also be removed.

This simplification should allow consumers to better compare and control their energy consumption, which was previously more difficult due to a tangle of charges and costs on the energy bill.

According to a report by the Electricity and Gas Regulatory Commission (Creg), the current energy bill is too long and unreadable for many people, especially those in a situation of energy poverty.

Social tariffs for gas and electricity on the rise again

Social tariffs for gas and electricity are rising again on 1 January. In one year, the social tariff for electricity has increased by 36% and that for gas by 45%, according to the Creg, the regulatory commission.

Find out more aboutWhat if your electricity and gas supplier goes bankrupt?

By Muriel Sparmont

Journalist at the General Newsroom

THE MEUSE Liege |

This is an extremely rare occurrence, says the FEBEG, Belgian Federation of Electricity and Gas Companies, which represents electricity producers, electricity and gas traders and suppliers, as well as laboratories in these sectors.

Click here to discover the article on LaMeuseThe social tariff for electricity and/or natural gas is a reduced tariff reserved for certain categories of people or households such as social recipients. It is identical for all energy suppliers and includes the energy component, the distribution component (tariff of the distribution network) and the transport component (tariff of the transport network). Since July 1, 2020, the Creg has set the amount of the social tariff every three months.

Due to high energy prices, social tariffs have been increasing for some time. Compared to the first quarter of 2021, the electricity tariff in January, February and March will be 36% higher and that of gas by 45%. Compared to the fourth quarter, this is an increase of 8.2% and 10.5% respectively.

A new tax decree in Wallonia, for a "fairer tax"

The Walloon government has validated a new tax decree which will make it possible to move towards "a fairer tax". This new text makes it possible to fight more effectively against practices intended to escape and/or have effect from January 1, 2022.

They relate to the regional tax procedure with, in particular, the establishment of a general anti-abuse provision, an extension of the extraordinary time limits for investigation and taxation from 5 years to 10 years in the event of fraudulent intent, the adaptation and extension of special taxation periods up to 10 years, in particular for taxation on the basis of new elements, clarification and strengthening of the system of fines in tax matters and clarification of the principle of erasure of the professional secrecy of tax officials when want to act as whistleblowers.

In terms of inheritance tax, we no longer pay registration duties at the time of the gift but rather inheritance tax at the time of death.

The anti-abuse measure by which manual donations (unregistered) made before death are still subject to inheritance tax will be extended from 3 to 5 years.

The possibilities of escaping inheritance tax via a life insurance mechanism are greatly reduced.

Automotive taxation is also affected by these measures since the favorable tax regime for tax vans is reserved for professional users.

The favorable tax regime for heritage vehicles is limited to those registered under an "ancestor" registration, in addition to being registered for more than 30 years.

Finally, there is a new tax regime linked to the use by a Belgian resident of a vehicle with a foreign registration when it does not comply with the rules relating to exceptions to the obligation to registration.

Mandatory expertise to obtain a mortgage loan

Since January 1, 2022, banks have been obliged to carry out an expertise of the property before granting a mortgage loan. But it does not necessarily have to be carried out by an expert on site, a statistical model can also be used.

The loan amount is now calculated on the basis of the estimated value and no longer on the purchase price. The National Bank expects banks to rely on a statistical model in most cases, thereby avoiding the additional costs of having an expert on site.

“An on-site visit is only necessary, for example, if the value of the building cannot be determined with sufficient certainty, if the database does not contain enough properties with similar characteristics or if specific characteristics of the property must be taken into account”, she had already specified in September.

The borrower is not necessarily obliged to provide the difference between the appraisal value and the purchase price. Banks can grant 35% of loans exceeding 90% of the value of the property to people buying a home for the very first time but retain some leeway, according to the National Bank.

Exemption ceiling raised for scholarship students who work

Scholarship students who receive social integration income (RIS) will see the socio-professional exemption ceiling to which they may be entitled increased claim when they work, up to the ceiling applied to non-scholarship holders, i.e. an increase from 72.23 euros per month to 264.13 euros per month. This measure initiated at the start of the coronavirus crisis is now final.

The difference in treatment between scholarship and non-scholarship students was born from the idea that a student should not work to devote himself to his studies: the higher exemption therefore compensated for the scholarship.

But today, more and more young beneficiaries of the RIS – whether they receive a grant or not – have a student job to be able to pay for their studies and the costs associated with them.

Indexation of the kilometer tax for heavy goods vehicles in Wallonia

The kilometer charge rates for heavy goods vehicles have been increasing in Wallonia since 1 January 2022 due to indexation.

The rates applied are valid for all heavy goods vehicles, Belgian and foreign, with a maximum authorized mass (MAM) of more than 3.5 tonnes, as well as category N1 semi-trailer tractors bearing the code BC bodywork.

The kilometer charge rates were already indexed in Flanders and Brussels on 1 July.

Release nurses from testing and vaccination centers to assign them elsewhere

The new emergency law that was recently passed allows the integration of profiles other than that of nurses, nurses and doctors, in testing and vaccination centers from 1 January.

Find out more aboutNurses' discomfort does not discourage students. Especially in intensive care!

By Corinne Toubeau

Journalist The Province

THE MEUSE Liege |

Bad weather for nurses. Does the crisis they are going through risk aggravating the shortage of caregivers? Interview with Ludovic Ghislain, emergency nurse, teacher at Condorcet and head of the brand new master's degree in nursing.

Click here to discover the article on LaMeuseIn this way, it is possible to appeal to medical and nursing students, laboratory students, midwives, dentists, pharmacists, pharmaceutical assistants, speech therapists, paramedics with 2 years of experience, oral hygienists, medical laboratory technologists and caregivers, both to perform PCR tests and to administer the Covid vaccine.

The measure makes it possible, in particular, to release certain nurses from these prerogatives so that they can devote themselves to other tasks.

Nappies are changing bins in all municipalities affiliated with Intradel

As of January 1, nappies in organic waste are over in all municipalities affiliated with Intradel, announced the waste management intermunicipal organization in the province of Liège. Some municipalities had already taken the plunge on January 1, 2021.

“If these nappies are extracted from the composting process, it is now necessary, both in economic terms and in terms of the quality of the compost, to eliminate children’s nappies from the organic fraction”, underlines Intradel.

Nappies make up about 45% of the unwanted items in organic waste containers. “Leaving them there would be tantamount to spreading 280 plastic particles per m² of cultivated land on arable fields. »

This is why since January 1, 2022, nappies must be disposed of in residual household waste.

Additional rules for exporting goods to the UK

A series of new measures came into effect on January 1 for companies exporting goods to the UK, reports the Flemish body responsible for promoting exports (Flanders Investment & Trade – Fit). The impact of these measures is still difficult to pin down, adds the Fit.

Doing business with the British in 2021 has not been easy for Belgian exporters due to Brexit. According to the Fit, things shouldn't improve right away as many changes have been postponed or scheduled for 2022.

The UK import models thus change on January 1st. A prior declaration for goods leaving the European Union will then be required if they are to enter Great Britain. All products of plant or animal origin must also be declared before leaving the EU. Finally, it is no longer possible to postpone your customs declaration. A completed UK import declaration is mandatory from today.

A week later, on the 7th, the transition period for the automatic recognition of naturally mineral European water ends. Any company still wishing to export such a good to the United Kingdom must submit an application before this date.

Increase in the cap on flat-rate allowances for volunteers in the care sector

The annual cap on flat-rate allowances for volunteering in the care sector has been raised since 1 January. The scope of the measure encompasses both the private and public health sector, including vaccination centres.

The annual ceiling for fixed compensation of 1,416.16 euros is increased to 2,600.90 euros. Volunteers who receive the maximum daily allowance of 35.41 euros will therefore be able to work up to 74 days a year instead of 40 previously, specifies the office of Minister of Health Frank Vandenbroucke.

Mandatory eco-participation for the recycling of photovoltaic panels

The environmental contribution for photovoltaic panels comes into force today in the Walloon Region. This obliges companies putting photovoltaic panels on the market for the first time to finance their collection and recycling.

In concrete terms, anyone who installs photovoltaic panels is charged a tax of 2 euros excluding VAT per panel, the same amount as in Flanders and Brussels where a similar tax is already in force. This is used to finance the non-profit organization PV Cycle, which collects and processes used photovoltaic panels. This tax will not be retroactive.

As in the Flemish and Brussels-Capital Regions, recycling, deposit at a collection point, or on-site removal are fully covered by the environmental contribution. Sign owners will therefore not have to pay any additional charges.

Prohibition of the tacit renewal of dormant energy contracts

Dormant energy contracts can no longer be tacitly renewed since January 1, 2022. Energy suppliers must now inform the customer and offer him a new contract when it is no longer active or its price differs from the current energy price.

A dormant energy contract is a contract which is in fact no longer available on the market, but which is tacitly renewed by the supplier. The consumer therefore continues to pay the old price. Customers who benefited from a temporary reduction at the start of the contract are often concerned.

For open-ended contracts, the energy supplier has until March 1, 2022 to bring its business practices into line with the new legislation.

Record increase for fire insurance premiums

The amount of fire insurance premiums increased by 5.6% on January 1, 2022, thus following the progression of the Abex index , increased from 858 to 906 between November 2020 and November 2021.

“More precisely, it is the insured capital, which corresponds to the reconstruction value of the home, which is indexed according to the Abex index. But this leveling of insured capital obviously has an impact on fire insurance premiums,” explains Assuralia.

Such an increase of 5.6% had not been observed since 2007 (+5.88%).

The Abex index, published according to the evolution of construction prices (which rose sharply in 2021 following shortages of materials), is used by 98% of insurers to change the amount of the prime.

The regulations on the exemption from VAT for medical care are changing

The regulations on the exemption from VAT on medical services are changing as of January 1, 2022.

The VAT exemption for personal medical care services applies to medical care services provided within or outside the context of hospitalization. However, the exemption does not apply to services relating to interventions and treatments without any therapeutic purpose.

On this point, the existing exemption will be even more restricted, according to the FPS Finance. Taxation is generalized to all operations without any therapeutic purpose, including services of an aesthetic nature.

In addition, the exemption is no longer exclusively reserved for practitioners of regulated medical or paramedical professions. Practitioners who can be considered to have an equivalent level of qualification through adequate training (including some unregulated paramedical practitioners) will also be able to claim the exemption.

The benefits of medical care to the person with a therapeutic purpose are services aimed at diagnosing, treating, and, as far as possible, curing illnesses or health anomalies. Medical services performed with the aim of protecting, including maintaining or restoring the health of persons also benefit from the exemption. Finally, the exemption is also applicable to the provision of medical care provided for the purposes of prevention.

Right to be forgotten for people cured of cancer wishing to take out insurance

Insurers can no longer take into account a cancerous pathology to refuse a request for guaranteed income insurance since this 1st January 2022. A binding code of good conduct for member companies of the professional union of insurance companies, Assuralia, will come into force on this date.

The conditions of this “right to be forgotten” are clearly defined. A period of 10 years must have elapsed since the end of the successful treatment without further treatment being necessary. The only exception is for treatment of the type of preventive hormone therapy which may have been taken during the 10-year period. In addition, no relapse may have occurred during this 10-year period, and the candidate-insured may not have been incapacitated for work during these 10 years as a result of his cancerous pathology.

Salary supplement for specialized nurses

Nurses with a recognized specialization have benefited from a salary supplement since January 1st.

With this supplement, Federal Minister of Public Health Frank Vandenbroucke (Vooruit) wants to rectify an anomaly. It has indeed appeared that the new IFIC classification system does not value or does not sufficiently value the specialization of certain nurses. “And this, while the question of specializations arises, among other things, in the emergency and intensive care services and that these services play a key role during this pandemic”, explains the cabinet of the minister.

The supplement takes the form of a lump sum. Either an additional 2,500 euros gross on an annual basis for specialized nurses holding a particular professional title, or an additional 833 euros gross on an annual basis for specialized nurses holding a particular professional qualification.

The package is granted from January 1, 2022, but the measure will not be felt immediately. The award will be retroactive because the technical development will take several months.

SOS Public Hospital: our revelation...

The best smartphones for gaming in...

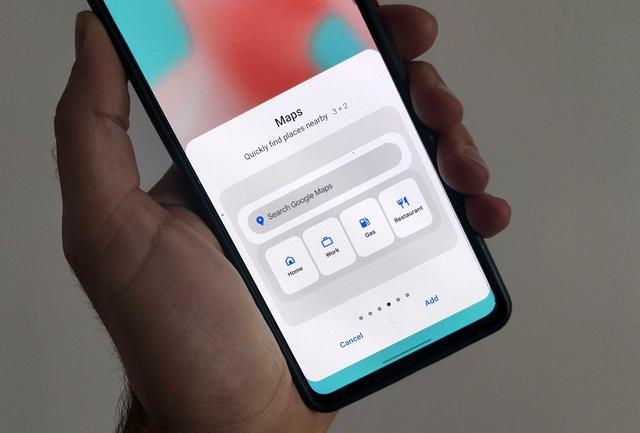

Google Maps: activate the new widge...

Free tips in video: Free Mobile off...